Qualified Dividends Worksheet - Although many investors use schedule d. An alternative to schedule d. Web qualified dividends and capital gain tax worksheet: Web enter your total qualified dividends on line 3a. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web nonqualified dividends include: Web shows total ordinary dividends that are taxable. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Dividends paid by certain foreign companies may or may not be qualified. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b.

2021 Qualified Dividends And Capital Gains Worksheet Line12A

Web qualified dividends and capital gain tax worksheet: Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web what is the qualified dividend and capital gain tax worksheet? Web how do you know if your dividend is qualified? You can find them in the form.

Qualified Dividends And Capital Gains Worksheet 2010 —

Web qualified dividends and capital gain tax worksheet—line 11a. Web how do you know if your dividend is qualified? Use the qualified dividends and capital gain tax worksheet in the instructions for. Web nonqualified dividends include: Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web in the united states, a dividend eligible for capital gains tax rather than income tax. Although many investors use schedule d. Web report your qualified dividends on line 9b of form 1040 or 1040a. Figuring out the tax on your qualified dividends can be. Web the strangest fluke of the tax return is that the actual calculation of how.

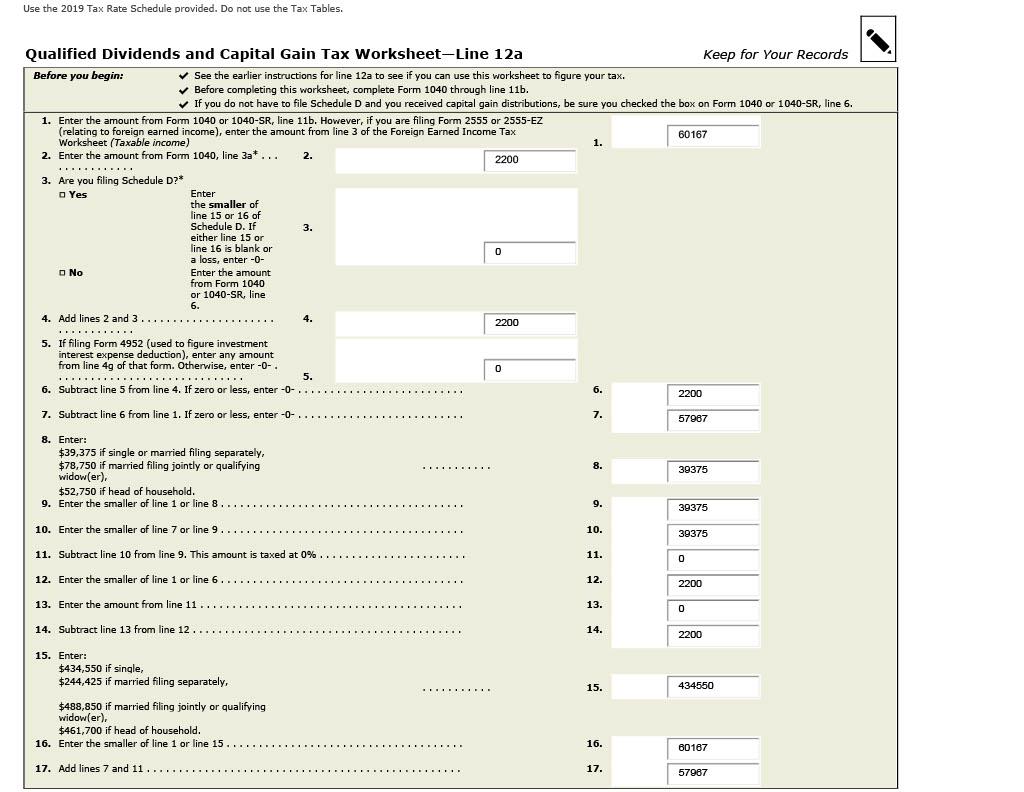

Solved Please help me with this 2019 tax return. All

Web in the united states, a dividend eligible for capital gains tax rather than income tax. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web qualified dividends and capital gain tax worksheet: Web report your qualified dividends on line 9b of form 1040 or 1040a. Web qualified dividends and capital gain.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web qualified dividends and capital gain tax worksheet: Web shows total ordinary dividends that are taxable. Use the qualified dividends and capital gain tax worksheet in the instructions for. Web in the united states, a dividend eligible for capital gains tax rather than income tax. You can find them in the form.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Web qualified dividends and capital gain tax worksheet: Web what is the qualified dividend and capital gain tax worksheet? An alternative to schedule d. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital.

Qualified Dividends And Capital Gains Worksheet 2018 —

Dividends paid by certain foreign companies may or may not be qualified. Figuring out the tax on your qualified dividends can be. Web qualified dividends and capital gain tax worksheet—line 11a. Web nonqualified dividends include: Web qualified dividends or a net capital gain for 2023.

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web shows total ordinary dividends that are taxable. You can find them in the form. Web report your qualified dividends on line 9b of form 1040 or 1040a. Use the qualified dividends and capital gain tax.

Qualified Dividends and Capital Gain Tax Worksheet

This is advantageous to the investor as capital. Although many investors use schedule d. Web shows total ordinary dividends that are taxable. Web nonqualified dividends include: Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or.

Qualified Dividends And Capital Gains Worksheet 2018 —

Figuring out the tax on your qualified dividends can be. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web what is the qualified dividend and capital gain tax worksheet? Web in the united states, a dividend eligible for capital gains tax rather than income tax. Prior to completing this file, make.

Web in the united states, a dividend eligible for capital gains tax rather than income tax. Web qualified dividends and capital gain tax worksheet: Web nonqualified dividends include: Web what is the qualified dividend and capital gain tax worksheet? Prior to completing this file, make sure you fill out. You can find them in the form. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. This is advantageous to the investor as capital. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Although many investors use schedule d. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Turbo tax describes one method for your dividends to be. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web qualified dividends or a net capital gain for 2023. Web how do you know if your dividend is qualified? Dividends paid by certain foreign companies may or may not be qualified. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Web these are the rates that apply to qualified dividends, based on taxable income, for the tax return that was due.

Web Qualified Dividends And Capital Gain Tax Worksheet (2022) • See Form 1040 Instructions For Line 16 To See If The.

Prior to completing this file, make sure you fill out. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Although many investors use schedule d. Web report your qualified dividends on line 9b of form 1040 or 1040a.

Use The Qualified Dividends And Capital Gain Tax Worksheet In The Instructions For.

Web what is the qualified dividend and capital gain tax worksheet? You can find them in the form. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Web nonqualified dividends include:

Web These Are The Rates That Apply To Qualified Dividends, Based On Taxable Income, For The Tax Return That Was Due.

Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web enter your total qualified dividends on line 3a. This is advantageous to the investor as capital.

Figuring Out The Tax On Your Qualified Dividends Can Be.

Web qualified dividends and capital gain tax worksheet: Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web how do you know if your dividend is qualified? Web in the united states, a dividend eligible for capital gains tax rather than income tax.