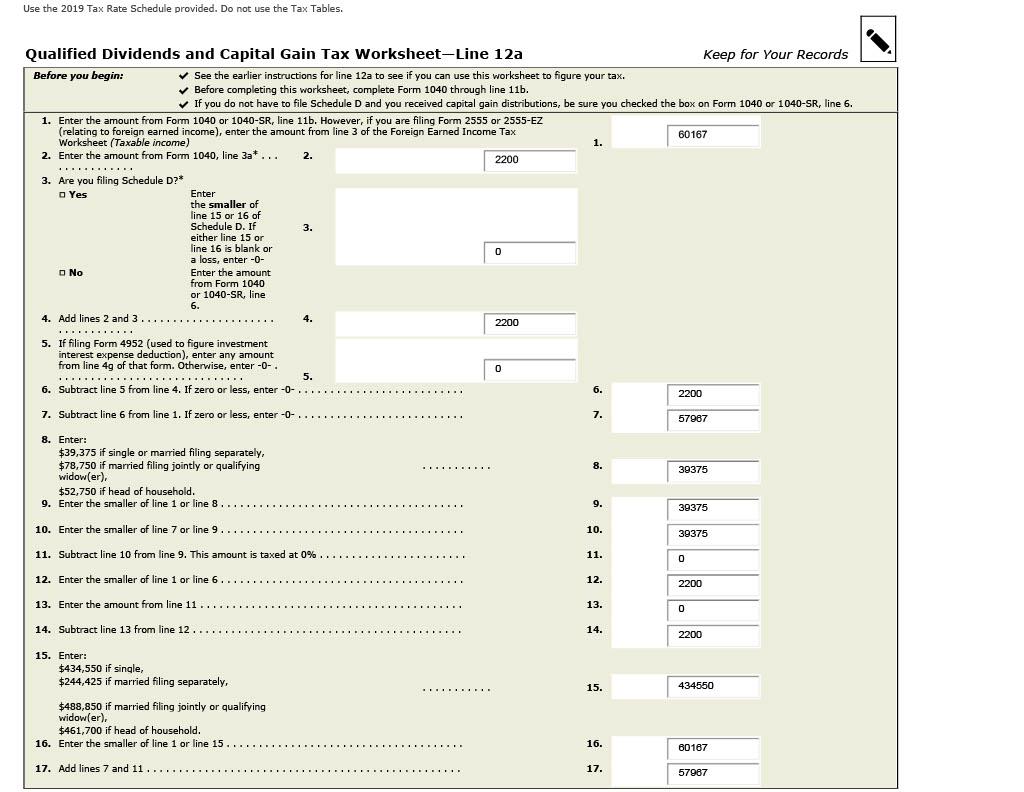

Qualified Dividends And Capital Gains Tax Worksheet - Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,. Also use schedule d, form 8824, and the qualified dividends and capital gain tax worksheet or the schedule d tax. (form 1040) department of the treasury internal revenue service. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Complete this worksheet only if line. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web following this example, there is a simple way to calculate the tax:

Create a Function for calculating the Tax Due for

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. There are three tax rates—0%,. (form 1040) department of the.

Solved Please help me with this 2019 tax return. All

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web qualified dividends.

Capital Gains Tax Spreadsheet Shares Payment Spreadshee capital gains

There are three tax rates—0%,. With $700,000 in both qualified dividends and. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Use the qualified dividends and capital gain tax worksheet to figure your. Also use schedule d, form 8824, and the qualified dividends and capital gain tax worksheet.

Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet

Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. With $700,000 in both qualified dividends and. There are three tax rates—0%,. Web following this example, there is a simple.

Qualified Dividends And Capital Gains Worksheet 2018 —

(form 1040) department of the treasury internal revenue service. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Also use schedule d, form 8824, and the qualified dividends and capital gain tax worksheet or the schedule d tax. Web the qualified dividends and capital gain tax worksheet can.

Qualified Dividends And Capital Gain Tax Worksheet —

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. With $700,000 in both qualified dividends and. Also use schedule d, form 8824, and the qualified dividends and capital gain tax worksheet or the schedule d tax. There are three tax rates—0%,. Web a qualified dividend is described as a dividend from stocks or shares taxed.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based.

Qualified Dividends And Capital Gains Worksheet 2018 —

With $700,000 in both qualified dividends and. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web the worksheet is for taxpayers with dividend income.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Complete this.

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. With $700,000 in both qualified dividends and. Web use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web following this example, there is a simple way to calculate the tax: Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Use the qualified dividends and capital gain tax worksheet to figure your. Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet. Web the capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held. It is for a single taxpayer, but. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. There are three tax rates—0%,. (form 1040) department of the treasury internal revenue service. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax.

Web The Irs Recently Released The New Inflation Adjusted 2022 Tax Brackets And Rates.

Web qualified dividends and capital gain tax worksheet. Web following this example, there is a simple way to calculate the tax: It is for a single taxpayer, but. Complete this worksheet only if line.

Web Qualified Dividends And Capital Gain Tax Worksheet (2022) See Form 1040 Instructions For Line 16 To See If The.

Web the capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates.

With $700,000 In Both Qualified Dividends And.

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. (form 1040) department of the treasury internal revenue service. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Use the qualified dividends and capital gain tax worksheet to figure your.

Web The Worksheet Is For Taxpayers With Dividend Income Only Or Those Whose Only Capital Gains Are Capital Gain Distributions.

Ordinary income is everything else or taxable income minus qualified income. Web how can i find the qualified dividends and capital gain tax worksheet. turbotax deluxe windows posted june 7,. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet.