Qualified Dividends And Capital Gain Tax Worksheet - Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. Prior to completing this file, make sure you fill out. If “yes,” attach form 8949. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Ordinary income is everything else or taxable income minus qualified income. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Use the qualified dividends and capital gain tax worksheet. Web report your qualified dividends on line 9b of form 1040 or 1040a. Our publications provide fast answers to tax questions for.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web tax on all taxable income (including capital gains and qualified dividends). In order to use the qualified dividends and. Our publications provide fast answers to tax questions for.

Solved Please help me with this 2019 tax return. All

Web qualified dividends and capital gain tax worksheet—line 11a. For the desktop version you can switch to forms mode and open the worksheet to see it. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Enter the smaller of line 45 or line 46. Our publications provide fast answers to tax questions for.

Qualified Dividends and Capital Gain Tax Worksheet 2016

Our publications provide fast answers to tax questions for. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web use the qualified dividends and capital gain.

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Enter the smaller of line 45 or line 46. Web how is the qualified.

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Web qualified dividends and capital gain tax worksheet—line 11a. If “yes,” attach form 8949. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Prior to completing.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

It is for a single taxpayer, but. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Enter the smaller of line 45 or line 46. Web how is the qualified dividends and capital gain tax worksheet used? Web for 2003, the irs added qualified dividends and the new rates to the worksheet so.

Instructions Schedule Schedule 5 Qualified Dividends

Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web qualified dividends and capital gain tax worksheet. Web how is the qualified dividends and capital gain tax worksheet used? Our publications provide fast answers to tax questions for. Web qualified dividends and capital gain tax worksheet—line 11a.

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? It is for a single taxpayer, but. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Ordinary income is everything else or taxable income minus qualified income. Qualified dividends and capital gain.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Ordinary income is everything else or taxable income minus qualified income. Use the qualified dividends and capital gain tax worksheet. If “yes,” attach form 8949. Web the irs recently released the new inflation adjusted 2022.

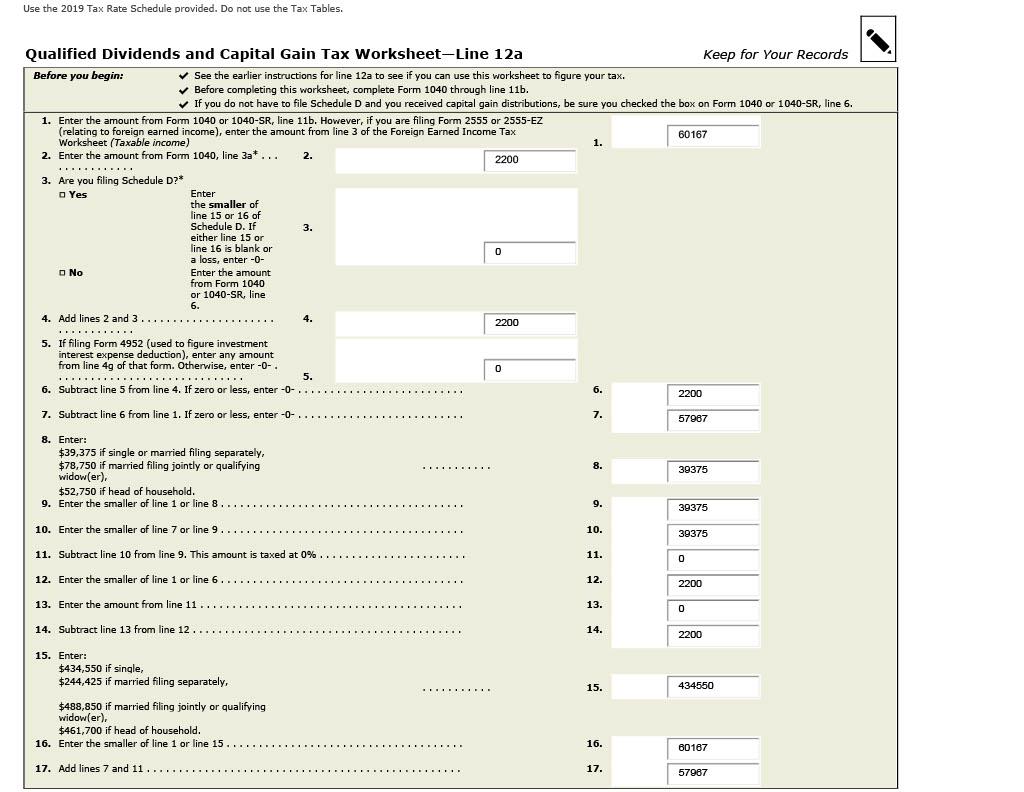

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

Web tools or tax rosea. Ordinary income is everything else or taxable income minus qualified income. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Our publications provide fast answers to tax questions for. Use the qualified dividends and capital gain tax worksheet to figure your.

Web tools or tax rosea. Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web tax on all taxable income (including capital gains and qualified dividends). Ordinary income is everything else or taxable income minus qualified income. (form 1040) department of the treasury internal revenue service (99) capital gains and losses. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Use the qualified dividends and capital gain tax worksheet to figure your. Web qualified dividends and capital gain tax worksheet. Enter the smaller of line 45 or line 46. Web how is the qualified dividends and capital gain tax worksheet used? If “yes,” attach form 8949. Use the qualified dividends and capital gain tax worksheet.

Enter The Smaller Of Line 45 Or Line 46.

Web get qualified dividends tax worksheet right now, together with an archive of thousands of legal templates and pdf files at formspal. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. It is for a single taxpayer, but. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the.

Web 1 Best Answer.

Use the qualified dividends and capital gain tax worksheet to figure your. (form 1040) department of the treasury internal revenue service (99) capital gains and losses. Prior to completing this file, make sure you fill out. Our publications provide fast answers to tax questions for.

In Order To Use The Qualified Dividends And.

Web tax on all taxable income (including capital gains and qualified dividends). If “yes,” attach form 8949. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income.

For The Desktop Version You Can Switch To Forms Mode And Open The Worksheet To See It.

Ordinary income is everything else or taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet—line 11a. Qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if. Web qualified dividends and capital gain tax worksheet.