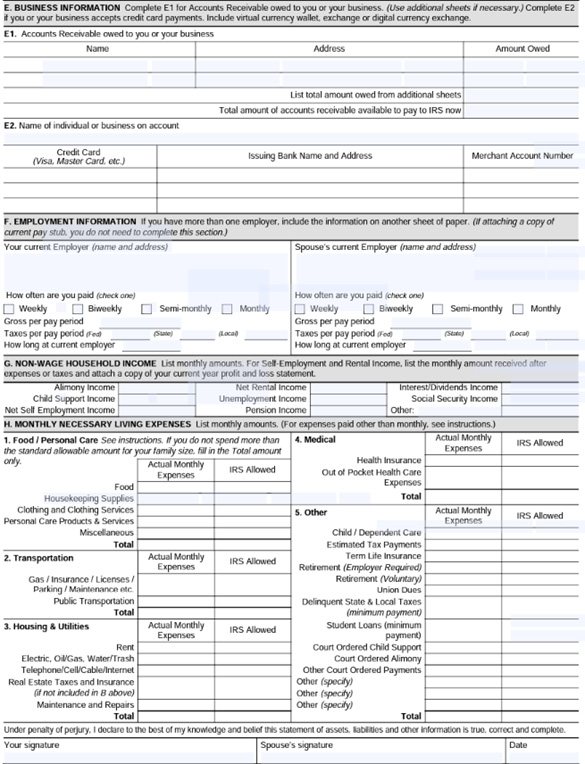

Printable Irs Form 433-F - Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. • lower user fees may be available through our. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status.

IRS Form 433F Instructions The Collection Information Statement

Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used.

Forma 433F/sp Declaracion De Ingresos Y Gastos (Collection Information Statement) 1999

• lower user fees may be available through our. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. Include the county and description, the year(s) and amount(s).

Form 433F Collection Information Statement Instructions printable pdf download

Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. • lower user fees may be available through our. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. It requires personal information, bank account records, real estate &.

Form 433F Collection Information Statement (2013) Free Download

Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently.

Fillable Form 433F Collection Information Statement Department Of Treasury printable pdf

It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. • lower user fees may be available through our. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. Include the county and description, the year(s) and amount(s).

32 433 Forms And Templates free to download in PDF

Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. • lower user fees may be available through our. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. The irs uses this information to determine their.

Guide to IRS Form 433F, Collection Information Statement

Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. • lower user fees may be available through our. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. It requires personal information, bank account records, real estate.

Fillable 433 Irs Form Printable Forms Free Online

Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used.

IRS Form 433F Who Should Use It?

• lower user fees may be available through our. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. Form 433f, also known as the collection information statement,.

How To Complete IRS Form 433F Step By Step Instructions

Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not.

• lower user fees may be available through our. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses.

Form 433F, Also Known As The Collection Information Statement, Is An Internal Revenue Service (Irs) Document Used To Gather Your.

Include the county and description, the year(s) and amount(s) of purchase and/or refinancing, the current market value and the amount you owe. The irs uses this information to determine their ability to pay and eligibility for payment plans or currently not collectible status. • lower user fees may be available through our. It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses.